Money matters are ever-evolving, influenced by global economic trends, market shifts, and technological advancements. It's crucial that our methods for teaching finance evolve in tandem. Recently, there's been an intensified push to enhance financial intelligence, particularly among families. This shift is pivotal because understanding finances isn't merely about crunching numbers—it's about making informed choices that pave the way to a stable and flourishing life.

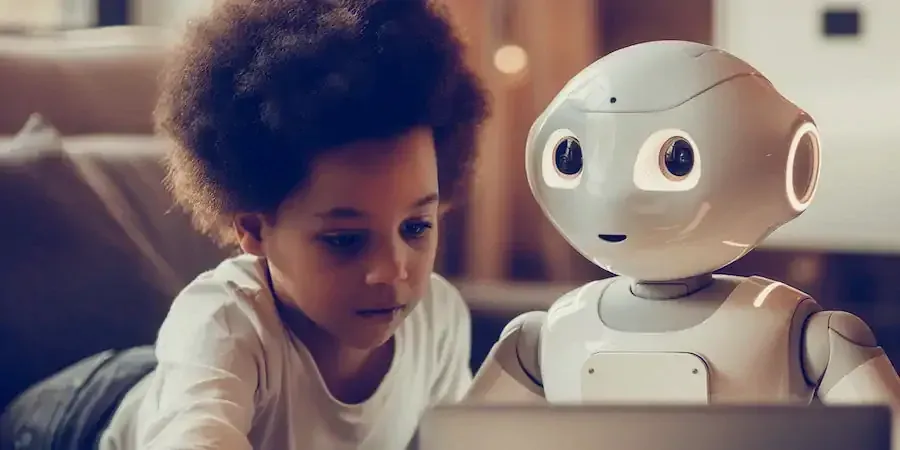

In this dynamic landscape, AI-driven educational tools are taking center stage. These tools transform the challenging task of learning finance into a tailored and enthralling experience. By utilizing artificial intelligence, these platforms can develop content that caters to the specific needs and learning styles of individuals, simplifying complex topics and making them applicable to various life situations. This transformation in financial education not only provides insights but also empowers families from diverse backgrounds to navigate their financial futures effectively.

AI's Impact on Financial Education

AI-driven platforms are revolutionizing the way families approach financial education. While traditional educational methods often dispense broad, generic information that may not resonate with every family member, AI technologies delve into user data to create highly personalized learning experiences. These platforms adjust the complexity and delivery of content to align with factors like the user’s age, existing financial knowledge, and individual financial aspirations.

Consider a teenager receiving an allowance: they might be introduced to foundational concepts like saving and budgeting, whereas a parent might delve into more sophisticated topics such as mortgages, retirement planning, or investment options. This customized approach ensures that each family member receives information that is not only relevant but also practical, significantly enhancing both the learning impact and engagement.

Moreover, AI tools are designed to adapt to the user's learning progression. If a learner is struggling with a specific concept, the platform can modify the pace or introduce different forms of interactive content to facilitate a better understanding. This adaptive learning strategy is essential for establishing a robust financial foundation for each family member, tailored to their individual learning curves and life stages.

The Transformation Brought by Interactive Tools

AI-enhanced platforms introduce interactive tools into financial education, such as budgeting simulators, investment planning activities, and debt management scenarios. These tools allow families to apply their newfound knowledge in a risk-free environment.

The significance of this development is twofold. Firstly, it renders the learning process more engaging, particularly for younger members who might find traditional educational approaches unappealing. Secondly, it offers a safe environment for experimentation. For example, through a budgeting simulator, users can manage a virtual budget, make spending decisions, and observe the consequences of these decisions without facing real-world risks.

This practical approach helps bridge the theoretical knowledge with practical application, an essential aspect of financial education. It allows learners to experience and learn from mistakes in a simulated environment, which can significantly alleviate the anxiety associated with making financial decisions in reality. Additionally, these tools can be tailored to simulate real-life financial challenges that a family might encounter, further enhancing the educational value and practical relevance of the learning experience.

Expanding Accessibility to Financial Education

AI-driven financial literacy platforms greatly broaden access to financial education. Typically hosted on the cloud, these platforms are accessible to anyone with an internet connection, which is particularly beneficial for underserved communities where access to conventional financial education resources might be limited.

These platforms are capable of reaching a vast audience at a relatively low cost, enabling the provision of free or affordable access to premium educational content. This extensive accessibility is vital for leveling the playing field, ensuring that individuals from all financial backgrounds have the opportunity to improve their financial literacy. Furthermore, the scalable nature of AI allows these platforms to continually update and expand their educational offerings based on the latest financial trends and insights, ensuring that the provided education remains relevant and current.

As AI becomes increasingly integrated into our daily lives, its influence on our financial well-being continues to grow. Families that adopt these innovative educational tools will not only enhance their financial understanding but also establish a solid foundation for future financial stability and success.