TRENDS

Stay updated with the latest trends in personal finance, including innovative tools and strategies that can help families navigate the complexities of the financial world for a secure future.

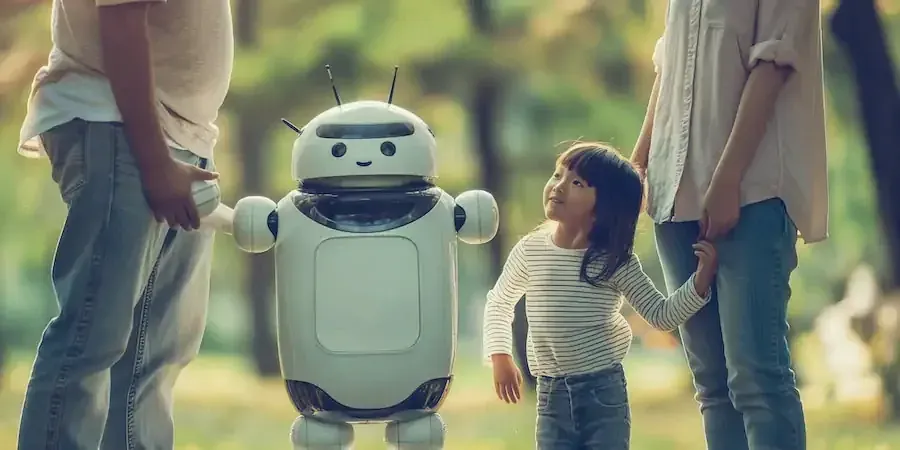

The Revolution in Family Financial Literacy Through AI

In our connected world today, the economic tremors of one area can send shockwaves worldwide, impacting both the stock market and household budgets. Families must not only grasp global economics' basic concepts but also delve into their complexities to secure and enhance their financial future. This guide dives into how Artificial Intelligence (AI) stands as a key companion for families aiming to conquer this complex landscape. By leveraging cutting-edge AI tools, families can unravel the intricate web of economic data and transform it into practical, tailored financial strategies.

The power of AI lies in its ability to process this information quickly and efficiently, allowing families to devise personalized financial strategies that are both intelligent and applicable to their unique circumstances. Through this guide, we explore the nuances of how AI can be a transformative factor for families looking to navigate and triumph over the challenges presented by the world's economic intricacies, thus turning these challenges into opportunities to thrive financially.

Unpacking Global Economics with AI:

AI has revolutionized how we handle economic info. Old-school techniques often mean wading through a deluge of financial news, reports, and forecasts—a daunting task for many. AI streamlines this by melding and dissecting data from myriad sources, offering insights that are not only reachable but also practical.

Take this, for example: AI algorithms can parse global economic reports, pull out crucial bits, and lay them out plainly. This means families can track key economic indicators like inflation, GDP growth, and job market trends without being economics wizards. Even better, AI can customize this data to fit a family’s unique financial scenario, offering advice that matches their long-term monetary ambitions.

Furthermore, AI's knack for predicting market trends and potential downturns allows families to tweak their investment strategies on the fly. Deciding when to branch out in investments or pinpoint the best moment to jump into emerging markets becomes simpler with AI’s deep understanding of global economics.

Real-Time Insights for Smarter Financial Decisions:

In financial planning, timing is critical. AI-driven platforms shine at offering instant analysis and foresight, crucial for families to make savvy decisions swiftly. These platforms keep tabs on current happenings and their potential economic impacts, providing forecasts that help families stay ahead of financial risks.

Imagine an AI system alerting a family about possible effects of new economic policies or international trade issues on their investments. With such real-time insights, families can proactively adjust their financial plans, maybe shifting funds or tweaking savings strategies before the market dips.

AI’s forecasts also clue families in on future prospects, like burgeoning markets or sectors likely to boom. This forward-looking advice is gold for long-term financial planning, positioning families advantageously well before these opportunities hit the mainstream.

AI and Global Financial Literacy:

AI is also transforming how families learn about global economics through AI-driven educational platforms. These platforms offer interactive courses and simulations that simplify complex financial concepts. They cater to all age groups and skill levels, making economic understanding more accessible than ever.

Families can try out virtual simulations that mimic real-world economic conditions, testing different financial strategies risk-free. This active learning not only enhances their financial knowledge but also gives them a clear picture of the impacts of their economic choices.

These platforms often feature community aspects too, letting families connect with experts and peers for advice and shared experiences. This community learning environment enriches the educational experience, supporting families as they navigate global financial complexities.

Prepping for Tomorrow’s Economic Landscape:

Looking forward, as economic landscapes continually shift, the value of staying informed and adaptable is paramount. AI equips families with a robust toolset for deciphering and responding to global economic dynamics, ensuring they are ready for any financial challenges ahead.

FAMILY HALO

FINANCIAL EDUCATION FOR REGULAR FAMILIES

+1 (904) 815-0735

©2023 Family Halo All rights reserved.

Family Halo is a 1901 French Association

RNA: W92202103

42 rue Jeanne Gleuzer, 92700 Colombes, France

Empower your family by leveraging our unique Family Finance Framework to double your financial literacy and half your stress, guaranteed.

Get in touch

Google Ads Disclaimer: This disclaimer states there is no guarantee of specific results and each person results may vary. The information on this site is not intended or implied to be a substitute for professional advice or consultation on the subject. All content, including text, graphics, images and information, contained on or available through this web site is for general information purposes only.

Family Halo makes no representation and assumes no responsibility for the accuracy of information contained on or available through this web site, and such information is subject to change without notice. You are encouraged to confirm any information obtained from or through this web site with other sources.

Family Halo does not recommend, endorse or make any representation about the efficacy, appropriateness or suitability of any information including sponsors’ information that may be contained on or available through this web site.

When you visit or log in to the Family Halo website, cookies and similar technologies may be used by our online data partners or vendors to associate these activities with other personal information they or others have about you, including by association with your email or home address. Family Halo (or service providers on our behalf) may then send communications and marketing to these email or home addresses. You may opt out of receiving this advertising by visiting https://app.retention.com/optout